Benefit In Kind Motor Vehicles Malaysia 2018 Table

Benefits in kind public ruling no.

Benefit in kind motor vehicles malaysia 2018 table. Ascertainment of the value of bik 3 7. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. Benefits in kind third addendum to public ruling no.

Diesel company cars incur an additional 3 benefit in kind tax supplement up to a maximum of 37. The government has stated this will remain in place until april 2021. Inland revenue board of malaysia benefits in kind public ruling no.

2 2004 date of issue. The table below shows bik tax bands based on vehicle co2 emissions. A ruling may be withdrawn either wholly or in part by notice of withdrawal or by publication of a new.

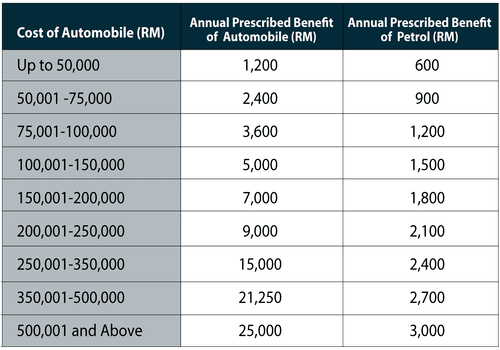

Motorcar means a motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers. Rm20 100 x 20 rm4 020. Ascertainment of the value of benefits in kind 3 6.

Particulars of benefits in kind 4 7. Benefits in kind bik generally non cash benefits e g. Rm12 000 x 20 rm2 400.

2 2004 date of issue. These benefits are called benefits in kind bik. Relevant provisions of the law 1 3.

3 2013 inland revenue board of malaysia date of issue. It sets out the interpretation of the director general of inland revenue in respect of the particular tax law and the policy and procedure that are to be applied. Total taxable bik income.

3 2013 date of issue. Related provisions 1 4. Cost of motorcar means actual cost of the motorcar.

Benefits in kind public ruling no. Motor cars provided by employers are taxable benefit in kind. In the above example it is better to choose the prescribed method as it will result in.

A ruling is issued for the purpose of providing guidance for the public and officers of the inland revenue board of malaysia. Bik bands have currently been set until 2019 20. 7 000 refer to table above fuel per annum actual amount 5 000.

There are several tax rules governing how these benefits are valued and reported for tax purposes. Accommodation or motorcars provided by employers to their employees are treated as income of the employees. 17 april 2009 director general s public ruling a public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance for the public and officers of the inland revenue board.

Let s assume the taxpayer s tax rate is at 20 the tax on bik is. What is benefits in kind bik 3 6. 15 march 2013 contents page 1.

12 december 2019 contents page 1. Summary of changes 1 3. The tax treatment in relation to benefit kind bik received by an employee from his s in employer for exercising an employment.

11 2019 date of publication. And one should also be aware of exemptions granted in. Benefit in kind rates.

8 november 2004 inland revenue board malaysia 1. Inland revenue board of malaysia benefits in kind public ruling no. 15 march 2013 page 2 of 28 4 4.